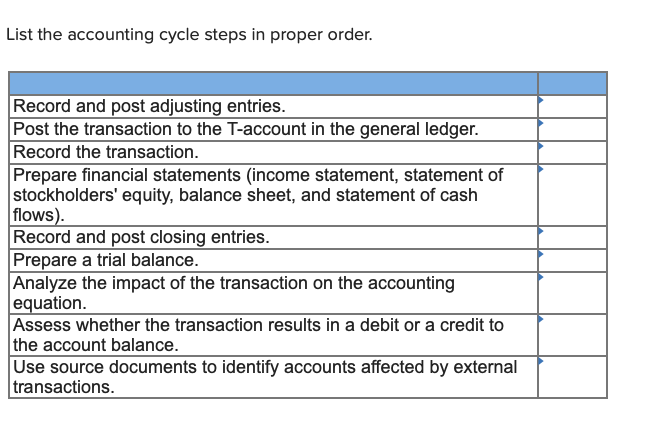

For example; the sale or return of a product, the purchase of supplies(raw materials or finished goods) for business operations or any other activity. An analysis of the business transaction forms the first step of the accounting cycle. The Accounting Cycle is https://personal-accounting.org/what-is-the-accounting-cycle/ a nine-step standardized practice used by organizations &CPA firms to record and calculate financial transactions & activities. The steps of Accounting Cycle lists the process of analyzing, monitoring, and identifying the financial transactions of a company.

What are the 5 basic accounting principles?

Use the basic accounting equation to make a balance sheets. This is Assets = Liabilities + Owner’s Equity. Thus, a balance sheet has three sections: Assets, which are the resources owned; Liabilities, which are the company’s debts; and Owner’s Equity, which is contributions by shareholders and the company’s earnings.

It is used for its efficiency and compliance with federal regulations and tax codes. An adjusting entry is a journal entry made at the end of an accounting period that allocates income and expenditure to the appropriate years. Adjusting entries are generally made in relation to prepaid expenses, prepayments, accruals, estimates and inventory. Throughout the year, a business may spend funds or make assumptions that might not be accurate regarding the use of a good or service during the accounting period. Adjusting entries allow the company to go back and adjust those balances to reflect the actual financial activity during the accounting period.

Limits of the Accounting Equation

Are any steps optional in the accounting cycle?

There are two main types of inventory accounting systems: the periodic system and the perpetual system.

The first step in the accounting cycle is gathering records of your business transactions—receipts, invoices, bank statements, things like that—for the current accounting period. Accrual accounting is based on the matching principle, which is intended to match the timing of revenue and expense recognition.

Financial professionals will use the balance sheet to evaluate the financial health of the company. A publicly-held company must report to the Securities and Exchange Commission on a quarterly basis, so the accounting period for its financial reports to the SEC span three months. If a https://personal-accounting.org/ set of financial statements cover the results of an entire year, then the accounting period is one year. If the accounting period is for a twelve month period ending on a date other than December 31, then the accounting period is called a fiscal year, as opposed to a calendar year.

Golden rule for personal accounts

For example, a fiscal year ended June 30 spans the period from July 1 of the preceding year to June 30 of the current year. Ideally, the fiscal year should end on a date when business https://www.google.pl/search?biw=1434&bih=742&ei=Dfz4XYa0JdD6qwGdm7H4Cg&q=akcje+alphabet&oq=akciAlphabet&gs_l=psy-ab.1.1.0i7i30j0i13j0i8i13i30.40621.43387..45744…0.2..0.123.426.1j3……0….1..gws-wiz…….0i71j0i67j0i10j0i8i7i30.4EUtw_oSRIw activity is at a low point, so that there are fewer assets and liabilities to audit. For example, Cynthia will prepare a balance sheet, an income statement and a cash flow statement.

- The equity portion represents contributions by owners (shareholders) and past earnings.

- Cash accounting is a bookkeeping method in which revenues and expenses are recorded when received and paid, respectively, not when incurred.

- Joe wants to understand the financial statements and wants to keep on top of his new business.

Translate the Adjusted Trial Balance to Financial Statements

By matching revenues with expenses, the accrual method is intended to give a more accurate picture of a company’s true financial condition. Under the accrual method transactions are recorded when they are incurred rather than awaiting payment. This https://www.investopedia.com/terms/a/accounting-equation.asp means a purchase order is recorded as revenue even though fund are not received immediately. The same goes for expenses in that they are recorded even though no payment has been made. It shows a company’s assets, liabilities, and equity accounts.

Failure to record the adjusting entries can result in understatement of expenses and overstatement of income, which ultimately can affect the amount of taxes paid. An accounting cycle accounting cycle steps refers to a series of steps and procedures conducted during an accounting period. The cycle starts when a transaction happens until it is recorded in the financial statements.

Step 7: Prepare Financial Statements

For example, one company may use the regular calendar year, January to December, as the accounting year, while another entity may follow April to March as the accounting period. The accounting cycle is the system in which businesses record their transactions in order to prepare required financial statements. https://www.google.ru/search?newwindow=1&biw=1434&bih=742&ei=ju0JXt-7KqjrrgSr6pTYDg&q=%D1%82%D0%BE%D1%80%D0%B3%D0%BE%D0%B2%D0%B0%D1%8F+%D0%BF%D0%BB%D0%B0%D1%82%D1%84%D0%BE%D1%80%D0%BC%D0%B0&oq=%D1%82%D0%BE%D1%80%D0%B3%D0%BE%D0%B2%D0%B0%D1%8F+%D0%BF%D0%BB%D0%B0%D1%82%D1%84%D0%BE%D1%80%D0%BC%D0%B0&gs_l=psy-ab.3..0l10.92823.92823..93319…0.2..0.109.109.0j1……0….2j1..gws-wiz…….0i71.IdQTfldMEUQ&ved=0ahUKEwjfutror93mAhWotYsKHSs1BesQ4dUDCAo&uact=5 However, many business owners don’t understand this process fully, so we’re breaking it down in today’s post. These fundamental concepts will enable you to construct an income statement, balance sheet, and cash flow statement, which are the most important steps in the accounting cycle.

Recording is a basic phase of accounting that is also known as bookkeeping. In this phase, all financial transactions are recorded in a systematical and chronological manner in the appropriate books or databases. Accounting recorders are the documents and books involved in preparing financial statements.

What are the 3 steps in the accounting process?

Introduction to Accounting Basics Some of the basic accounting terms that you will learn include revenues, expenses, assets, liabilities, income statement, balance sheet, and statement of cash flows. You will become familiar with accounting debits and credits as we show you how to record transactions.

To learn more, check out CFI’s free Accounting Fundamentals Course. First, the source documents are analyzed to determine the nature of the accounts or transactions. Examples of source documents are checks and bank statements and other financial measures that are relevant to be journalized in the next step.

If you find any errors in the adjusted trial balance, correct them immediately. In bookkeeping, the accounting period is the period for which the books are balanced and the financial statements are prepared. However, the beginning of the accounting period differs according to the company.