CZĘSTOTLIWOŚĆ UŻYCIA SŁOWA «STAGFLATIONARY» NA PRZESTRZENI CZASU

All three of these factors combined cause stagflation—stagnation in production and employment together with increasing inflation. equation explains well the behavior of inflation after the Russian crises, when inflation increased sharply but was quickly brought under control, as the National Bank of Georgia kept its monetary policy tight and the exchange rate jak grać na forexie stable. Currency in circulation has strong information content for predicting future price level movements. The information content of other financial variables, such as the exchange rate and interest rates, is weaker. This worrying level of inflation rates results largely from sharp increases in energy and food prices at the global level in recent months.

A model of inflation with both forward and backward elements seems to characterize reality. Such an inflation model is estimated using data for industrial countries, and the output costs of a disinflation path are calculated, https://yandex.ru/search/?text=форекс%20обучение&lr=213 first analytically in a simple theoretical model, then by a simulation of a global, multiregion empirical model. The credibility of a preannounced path for money consistent with the lowest output loss is considered.

Stagflation is very costly and difficult to eradicate once it starts, both in social terms and in budget deficits. exchange rate and the price of coffee in determining an asset demand for money was mixed. Re-monetisation since the late 1980s has been slower than de-monetisation.

The inflation rate in the euro area is at its highest level for 10 years. This is very worrying, and stagflation also seems to be around the corner. Moreover, wage growth has been picking up in recent quarters, at a time when labour productivity growth has decelerated, resulting in sharp increases in unit labour costs. The continued high level of inflation is largely due to both the direct and indirect effects of past surges in energy and food prices at the global level.

An alternative, more credible policy may be to announce an exchange rate peg to a low-inflation currency. This paper reviews the evidence on stabilization plans in high inflation countries within a unified theoretical framework. These outcomes turn out to be consistent with the predictions of the analytical https://en.wikipedia.org/wiki/Nostro_and_vostro_accounts model. We theoretically investigate the role of expectations in modelling economic activity and the evolution of inflation rates. The New Keynesian Phillips-IS model is extended in our study by having two types of firms with a fraction of firms that uses ‘limited’ information to develop their expectations.

Visual Synonyms of stagflation

- equation explains well the behavior of inflation after the Russian crises, when inflation increased sharply but was quickly brought under control, as the National Bank of Georgia kept its monetary policy tight and the exchange rate stable.

- exchange rate and the price of coffee in determining an asset demand for money was mixed.

- Re-monetisation since the late 1980s has been slower than de-monetisation.

- The credibility of a preannounced path for money consistent with the lowest output loss is considered.

- Keynes did not use the term, but some of his work refers to the conditions that most would recognise as stagflation.

The euro has given us low inflation and low interest rates, thanks to a macroeconomic framework directed at stability. The paper develops a two-step estimator for use in rational-expectations models with autocorrelated residuals and predetermined, but not strictly exogenous, instruments. The estimator extends the applicability of McCallum’s error-in-variablesapproach https://en.wikipedia.org/wiki/Inventory to estimating such models, and is asymptotically efficient in a class of intrumental-variables estimators. As an application we use instrumental-variables techniques to estimate Taylor’s rational-expectations macroeconomic model of the United States. , Determinants of Wage Inflation Around the World, Brookings Papers on Economic Activity 6 , .

Since the collapse of the Bretton Woods system, some European countries have pursued discretionary exchange rate policies in order to maintain or enhance the international http://palebluedotdesigns.com/platformy-forex/ competitiveness of the traded goods sector. These countries, which typically feature centralized wage setting, have also tended to experience high nominal wage increases.

Kontrowersyjna strategia Szwecji wobec pandemii jest jednak skuteczna?

The remaining firms, which are referred to as forward-looking, would use all information available to set prices and make manufacturing budgets. Toestimate our augmented model, we employ the Uhlig priorirestrictions and the Nakajima (2011a) time-varying parameter regression. Our results suggest that the expectations of each type of firms play an important role in explaining the inflation rate and real economic growth in the UK.

stagflation

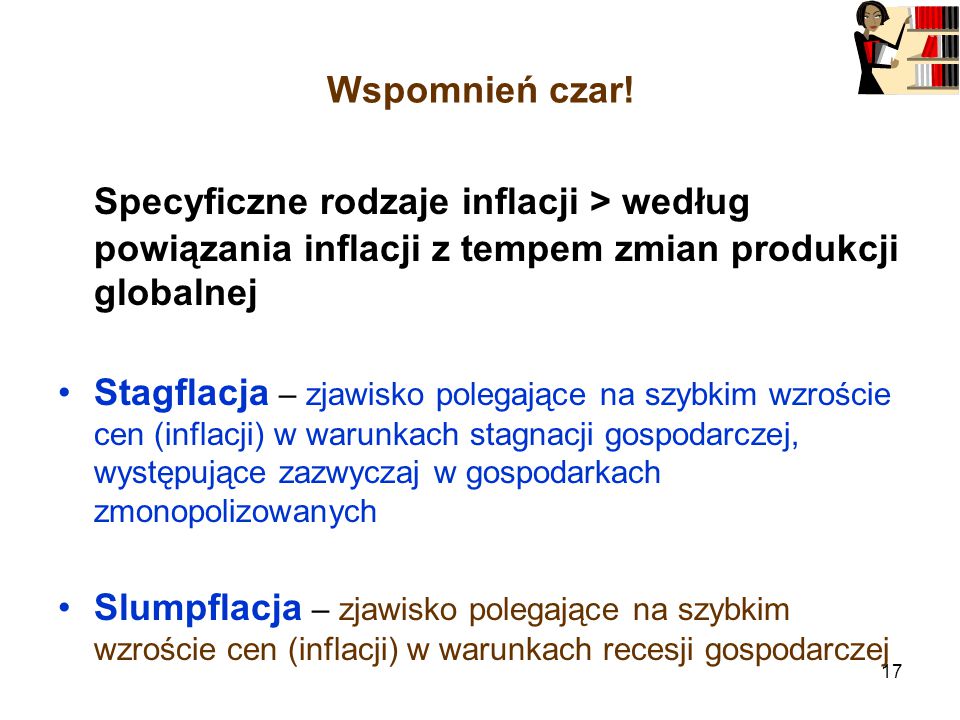

In particular, this generated a relatively abundant literature on the debate about the “stagflationary” impacts of the two main components of the stabilization programs, that is, restrictive monetary policy and devaluation of the exchange rate. In economics, stagflation, a portmanteau of stagnation and inflation, is a situation in which the inflation rate is high, the economic growth rate slows, and unemployment remains steadily high. It raises a dilemma for economic policy, since actions designed to lower inflation may exacerbate unemployment, and vice versa. The term is generally attributed to a British Conservative Party politician who became chancellor of the exchequer in 1970, Iain Macleod, who coined the phrase in his speech to Parliament in 1965. Keynes did not use the term, but some of his work refers to the conditions that most would recognise as stagflation.

This paper applies two models of repeated games to analyze the strategic interaction between an exchange rate setting policy maker and a wage setting trade union. It is shown how a devaluation-wage spiral may result from a conflict of interest over the real wage. It is also shown how reputational forces may provide a way out of the devaluation-wage spiral. The term stagflation is sometimes used to describe a situation in which there is slow to zero growth in real output, high inflation exists, and unemployment is higher than normal. This situation usually begins with rising prices at times when production is declining.