10 Tips for Starting a Bookkeeping Business

How Will Clients Get Their Receipts to You?

This is a unique job in that it’s something that, more often than not, can be done from home. Sometimes finding the perfect at-home job starts with finding a great traditional job and then transitioning it to being home-based. If you decide to work for a company that contracts with other organizations to provide bookkeeping services, you’ll still be working from home but you might have several different clients. To be a successful online bookkeeper, you need to be able to make a connection with your clients. Say for example a company makes sales in both cash and credit.

When a credit sale is made, the creditor’s account will be recorded. So at any time, the management of the company can determine which creditors owe them how much money by just looking at the records/accounts. The main objective of book-keeping is to keep a complete and accurate record of all the financial transactions in a systematic orderly, logical manner. This ensures that the financial effects of these transactions are reflected in the books of accounts.

Bookkeeping requires knowledge of debits and credits and a basic understanding of financial accounting, which includes the balance sheet and income statement.

Bookkeeping is the activities concerned with the systematic recording and classification of financial data of an organization in an orderly manner. It is essentially a record-keeping function done to assist in the process of accounting.

Part 5 – Final Part of your Bookkeeping Business From Home mini course

Given a lot of free time, many (not all) business owners are more than capable of doing their own bookkeeping. But business owners often wear multiple hats and need to perform a list of high level tasks for their business to run properly. As a cloud based accounting solution we see people often asking if bookkeeping is hard to learn, what does it involve, and how does it work. Most of those asking these questions are either business owners wondering if they should do their own bookkeeping, or people considering their career options. While we’ll try and address both sides of the issue, our focus will be on the business owners point of view.

If the company grows to a larger size, supervision of the accounting function is likely to be shifted to a controller. In this case, the full charge bookkeeper position may be converted into an assistant controller position, with responsibility for some aspects of accounting operations. With additional training, a full charge bookkeeper could be promoted into the controller position.

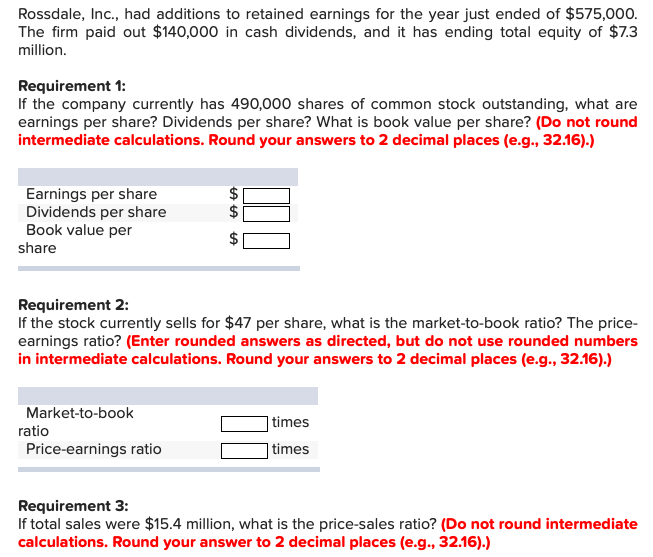

You will also create a financial plan that should include a 12-month profit and loss projection, projected Cash Flow, and a projected Balance Sheet. In addition to becoming a certified bookkeeper, you should also consider getting certified in a few of the leading accounting software providers, like QuickBooks and FreshBooks. Check out our Bookkeeper Certification guide for details on how software certifications work. One of the fastest ways to gain credibility with potential clients is to prove that you have the credentials to do bookkeeping work. If you are a CPA, then you have already demonstrated that you possess the knowledge and skills to perform the duties required of a bookkeeper, and you can proceed to the second step.

A business credit card can also be a great way to easily track your business expenses. One of the tools that you will use quite a bit is a document sharing program.

If you decide to go with QuickBooks, they offer a variety of payroll options to choose from. If you decide that you just don’t want the headache of dealing with payroll, check out our guide on 6 Payroll Competitors that beat ADP when it comes to price. Like starting any business, there are several administrative tasks that must also be done before you can start servicing customers. This step is an important one because it establishes your business as a legitimate one. Whether you are doing this part-time or full-time, you don’t want to skip this step.

Lori Fairbanks Lori Fairbanks has years of experience writing and editing for both print and online publications. As a small business owner, you need your financial data to be current and accurate so you can make good business decisions and ensure you have a healthy cash flow. But as your business grows and you take on https://www.bookstime.com/ more customers, vendors, and employees, keeping track of how much money you have coming in and going out of your business gets complex – and time-consuming. I was looking for some information regarding this and finally got one. this article definitely will help people who are trying to start a bookkeeping business.

- In bookkeeping, extra hours are common during the busy season of January to April.

- If your name was June Smith, then name your business June Smith Bookkeeping Services.

- OK. That completes this mini guide to setting up a bookkeeping business from home.

You can’t just start a business and wait for clients to start working with you. Not every part of online bookkeeping requires this much focus, however. There are tasks you can tackle when you can’t focus completely. These include marketing, answering emails, and working on networking with others.

Bookkeeper Business Launch Student Reviews

It is a key component in forming the financial statements of the organization at the end of the financial year. We often use the terms accounting and bookkeeping interchangeably. However, bookkeeping is actually just one part of the accounting process which ScaleFactor Review deals with the recording of the transactions. So let us learn about book-keeping and its differences with accounting. For the every so busy small business owner, finding the time and energy to properly maintain your books can be a taxing and arduous task.

Rob is a freelance journalist and content strategist/manager with three decades of experience in both print and online writing. He currently works in New York City as a copywriter and all across North America for a variety of editing and writing enterprises. Intuit lets you search for local accounting and bookkeeping professionals who are certified to work with its QuickBooks software.

One thing no bookkeeper should skip is finding a great banking partner. Azlo offers a free, online business checking account that’s great for any business that doesn’t handle cash. Azlo’s mobile app allows you to make payments, deposit checks, and schedule transfers from anywhere. The position is most commonly found in smaller organizations where there is no need for a controller, and which has relatively uncomplicated accounting transactions.

But, when it comes time to do the actual bookkeeping, you should have a distraction-free environment. Since many businesses and entrepreneurs need help with their books, this can be a profitable work-from-home opportunity. To help you make the decision, here are ten essential questions to ask yourself before becoming an online bookkeeper. Aside from applying to work for a bookkeeping company, you can look for an at-home bookkeeping job the same way you might look for a more traditional bookkeeping job.

Can a bookkeeper call themselves an accountant?

Accountants are a level up from bookkeepers. They can (but usually don’t) perform bookkeeping functions, but usually, they prepare detailed financial statements, perform audits of the books of public companies, and they may prepare reports for tax purposes.

Keeping books consistently is the key to creating a smooth experience. If you don’t have the time, the drive, the mindset or the know-how to stay on top of your books–you will find that bookkeeping is ten times the task it should be.

Ready to Start Your Own Bookkeeping Business?

Can a bookkeeper work from home?

A full-charge bookkeeper is the same as a bookkeeper, except that the “full charge” part of the title designates the person as being solely responsible for accounting. For example, a billing clerk, payables clerk, or payroll clerk may report to the bookkeeper.

In fact, a TD Bank survey which polled over 500 U.S. small business owners, discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. https://www.bookstime.com/articles/scalefactor Needless to say, you are not alone if you don’t enjoy categorizing transactions. And no task (even if simple) is “easy” when you not only don’t like doing it, but hate it.