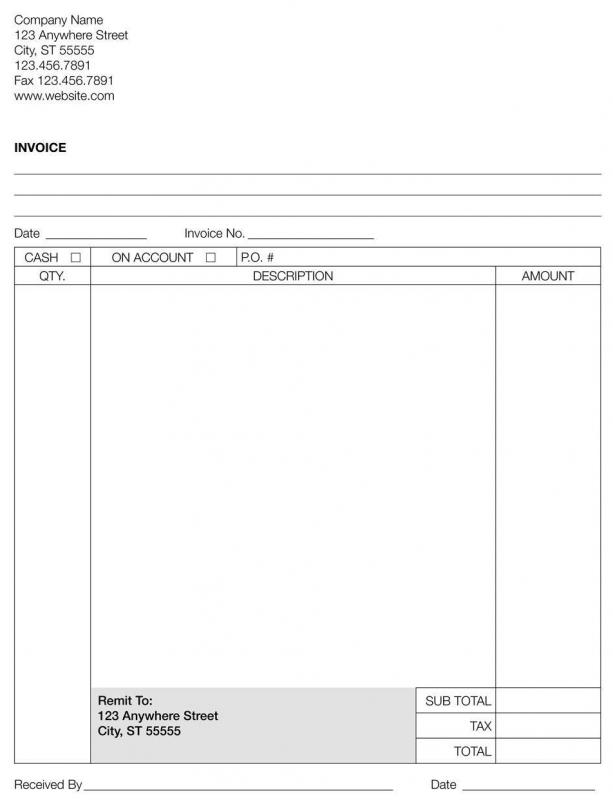

It’s useful to put the grand complete in daring font in order that it clearly stands out. Put in the shopper’s data (normally beneath and on the alternative facet out of your firm’s contact info). And remember to embrace the identify of the business, mailing tackle, cellphone quantity, and e-mail.

Invoices had been one thing that people with duty knew the way to use. If you need your invoices to look skilled and reflect properly on your corporation, it is best to follow this template.

Kill Fee Details

But this all comes all the way down to what you and your shopper are comfy with. Here’s a quick listing of what ought to be included in your freelancer invoices. If all of this looks as if an excessive amount of, then it’s better to chorus from doing business with clients exterior of the countries you’re acquainted with. In different phrases, your bill ought to be correct, containing a detailed listing of the services/merchandise offered and a breakdown of the fees charged. In a nutshell, freelancers who offer services or products to an organization can invoice them.

What Does an Invoice Include?

FreeAgent is registered with the Financial Conduct Authority beneath the Payment Services Regulations 2017 (register no. ) for the supply of account info providers. Our HMRC-compliant invoices fill in all the knowledge the tax man requires. Choose a template from our gallery, or customise your own in CSS.

Packs of pre-printed bill templates may also be purchased at workplace provide stores and then written or typed individually as invoices are sent. These “guide” invoices can then be despatched electronically or by mail and usually must be tracked by hand for accounting purposes.

Is an invoice a legal document?

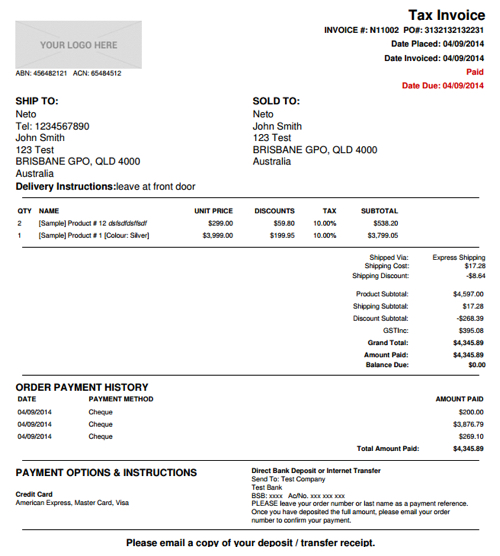

(i) the agreed charge, including any discounts, handling and freight charges and a breakdown clearly showing each VAT amount and the applicable VAT rate (and where not complete, a breakdown of the relevant work or services as they relate to this charge or an explanation of a difference in expected charge).

You might make the case that invoices are attached to issues which might be delivered, but in practice plainly varied trades over time have selected one time period or the opposite by custom and custom. Sometimes I am advised to pay my “bill”, and generally they could check with the similar paper (physical or virtual) as “bill”. The only distinction I can consider https://cryptolisting.org/ is that “bill” seems to be one thing you pay before you use while “invoice” is the other. But this distinction just isn’t clear since my university also calls the tutoring payment as invoice now (I am already finding out once I pay the “bill”). I noticed invoices in the same way that children see credit cards or examine books.

What Is a Sales Invoice? What’s Included?

This contains custom entry fields with things like firm title, address, cellphone number, e-mail, logo, fee terms, and official payee title for receiving payments. If you’re a small business proprietor, you should know how to create an invoice. The good news is that it’s fairly simple, especially when you use the proper instruments to streamline the method. In my mind, bill has a connotation of more particulars in the doc and monitoring (an bill quantity), that a invoice could not have. They convey you a bill at a restaurant, you get an invoice from a provider.

However, you may run into the same logistical challenges as sending invoices via Word. Break down services or products into line merchandise descriptions, along with costs related to every. Calculate the total, including any relevant gross sales tax, supply charges, etc.

Important Caveats to the 6-Year Old Invoice Rule

As a freelancer, you probably run your business under your own identify. Only a select few freelancers go the additional mile to call their companies Bookkeeping or even incorporate their sole proprietorship. This is how residential clients can protect themselves when coping with contractors who do work on their properties.

Creating an Invoice — 5 Important Steps to Avoid Mistakes How to create an invoices in 5 straightforward steps. Fill out the custom entry fields with issues like firm identify, handle, cellphone quantity, e mail, emblem, buyer ID (if relevant), cost terms, and official payee name for receiving funds. Excel offers a wide range of clear, straightforward-to-use invoice templates, depending on your wants.

where the invoice issued is a document or message handled as an bill pursuant to Article 219, specific and unambiguous reference to that preliminary bill and the particular particulars that are being amended. Within the European Union Value Added Tax directive, Article 226 is a concise definition of invoices inside the union member states.

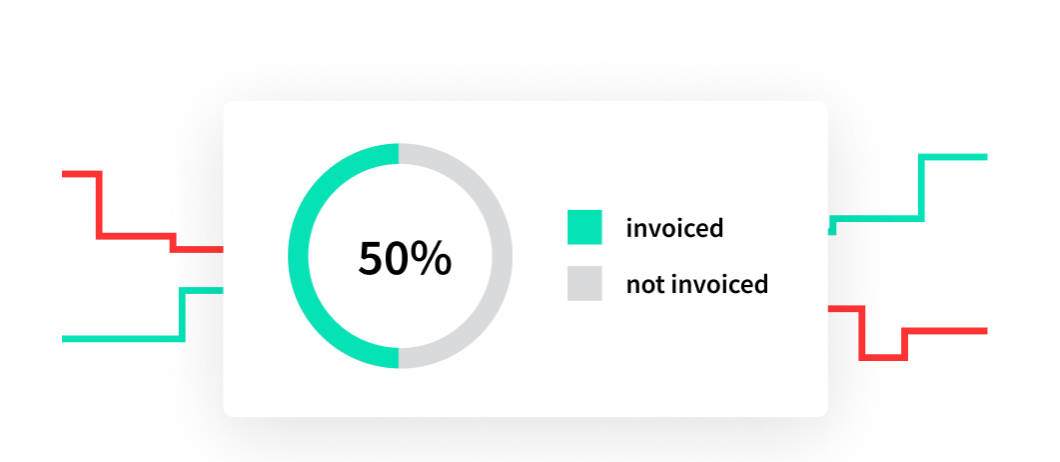

If you’ve a wholesale enterprise — for instance, should you create beauty merchandise that you simply promote to retail shops — an bill catered to your business is necessary to keep monitor of your massive transactions. The most simple https://cryptolisting.org/blog/what-are-the-costs-for-free-on-board function for a gross sales invoice is to keep a document of the sale. It offers a way to track the date a great was bought, how a lot money was paid and any excellent debt.

- Sometimes a variety of invoices should be rejected as they aren’t legitimate.

- This can improve your cash flow and make payments simpler in your shopper, too.

- As a part of your contract, you’ll want to defend yourself from making infinite rounds of revisions.

- It also acts as a proof of ownership in the case of transaction of goods.

- Both invoices and receipts are methods of monitoring purchases of goods and companies.

- For the buyer, invoices provide a breakdown of enterprise expenses, taxes paid, and vendor contact info.

Coronavirus small businesses support hub

You’d by no means use bill in a restaurant or in a division store. There is no substantial difference between the 2 phrases, besides that bill is more formal and technical. Bill in the sense we’re discussing is Anglo Saxon and dates from the 1400s, and invoice is French (envoyer, “dispatch”) from the 1500s.

OAGi also includes support for these Technology and Methodology specifications within OAGIS. They might not require details on invoices other than these referred to in Articles 226, 227 and 230.

Intuit and QuickBooks are registered logos of Intuit Inc. Terms and circumstances, options, help, pricing, and repair options subject to vary without discover.

It can also observe which staff make sales and the items they sell. At the top of the day, corporations are willing to pay for great work. If you’re a freelancer who takes satisfaction in their providers, then pleasing prospects is your high priority.

Also, be sure to finish off your bill thanking clients for their enterprise. Who doesn’t want recurring clients, particularly whenever you’re a freelancer? Consistently in search of new clients is tiring and may decelerate your productivity. Whatever platform you decide to make use of in your invoices, it’s a good suggestion to keep your whole invoices related. Having a template is right so your customers acknowledge your invoices.

Make positive every thing is spelled out in the invoice before agreeing to it and then you’re protected. Once each side conform to an invoice, it then becomes a authorized debt and an settlement. The buyer just isn’t sure to pay the invoice till the vendor has happy all parts of the bill. In most circumstances, the customer will define their terms of the transaction on a purchase order order. Further implementations are underway in the Scandinavian countries as result of the North European Subset project.

Implementations are also underway in Italy, Spain, and the Netherlands (UBL 2.zero) and with the European Commission itself. The XML message format for electronic invoices has been used since the inception of XML in 1998. Open Application Group Integration Specification (OAGIS) has included an invoice since 2001. The Open Applications Group (OAGi) has a working relationship with UN/CEFACT where OAGi and its members take part in defining lots of the Technology and Methodology specs.

How long is an invoice valid for?

A personal invoice is a tool you use to ask for money that the customer owed you or a bill that you send to the clients for the unpaid services or goods that you will send later. Personal invoice is usually used by freelancers to get paid easily and with the exact amount.

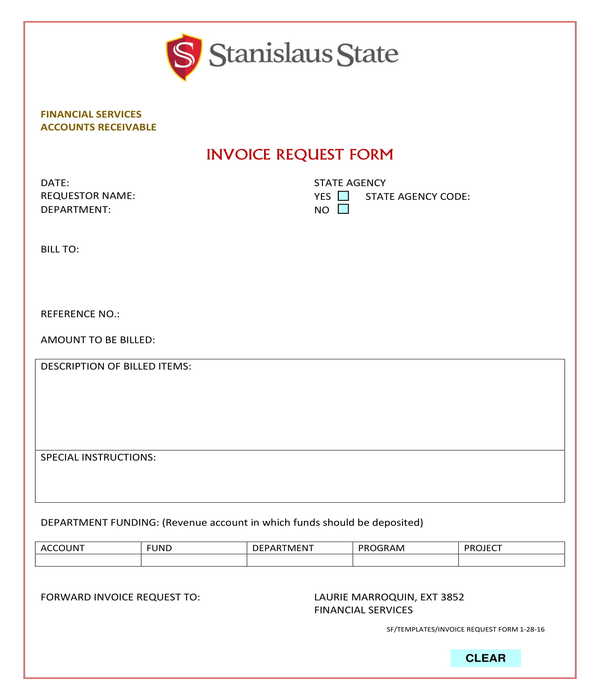

FreeAgent’s Chief Accountant Emily Coltman shares the elements for a profitable bill and descriptions HMRC’s invoicing necessities for VAT-registered businesses How is materiality determined?. Select the popular template thumbnail to enlarge it in a preview window. Click “Create” to repeat the invoice template into a brand new Word document.

Can anyone make an invoice?

From a customer or client point of view, invoices help them see what they’re getting for their money. That doesn’t mean you can’t be paid before sending an invoice, but it is the way that most business transactions work. Even if you are paid before you send an invoice, your customer will expect you to send one in.

Again, if you’re using an online invoicing platform, you’ll be able to settle for digital types of cost using bank cards or online portals. The methods of payment you settle for must be acknowledged in your bill. For instance, the forms of credit and debit cards bookkeeper you are taking and if there are any platforms they’ll pay via. And you could discover that you have completely different cost terms for every of your clients, which is ok. Some freelancers have due dates which are 7, 15, or 30 days from the time of the bill date.

With an digital invoicing platform, you can arrange recurring cost reminders to assist guarantee your customers never forget to pay you. You don’t wish to ship your bill too late and have the client push it aside as an alternative paying it. If you do a fantastic job on your venture, then ship an bill the same day or within 24 hours.

Why is it called invoice?

In and of itself, an invoice is not a legally binding agreement. The tenuous legal standing of an invoice is the very reason why vendors require signatures from the client, or some other binding form of acceptance, before sending out a product. The accountability works both ways for an invoice.

The whole due is the complete quantity owed by the client, including applicable sales tax and some other charges. The complete due often appears immediately under the total costs and other costs, and may also appear at the high of the bill for reference. A abstract of all charges associated with the gadgets or companies being billed seems below the line gadgets, although generally it’s on the top of the in the footer part as a substitute. If you’ve had to pay for some things that the client needs to cover, embrace these bills on the invoice.